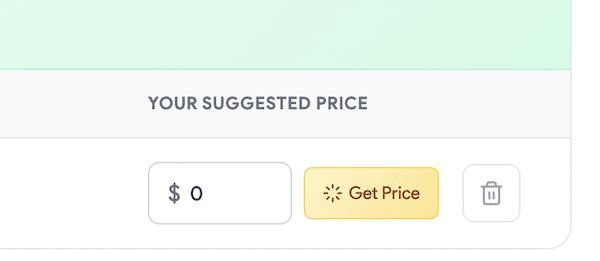

When you submit a domain name for sale on Atom.com, it allows you to enter your desired price or click the “Get Price” button for a price suggestion. When a domain name is approved as a Premium listing, Atom will provide an approved price, with bracketing that allows sellers to adjust the price. Seeing a big number can feel good and make you think you are sitting on a huge opportunity. Sellers should not blindly trust that number.

Here’s an example of why you shouldn’t entirely rely on Atom’s pricing suggestion for the asking price. I submitted a .AI domain name I recently acquired, and the Atom “AI Value” is $35,500. This seems great considering I acquired the name for less than $250. However, I can see the same keyword .com domain name is listed for sale for less than $20,000.